(From: Clever School District)

Guest Post by Retha Holland

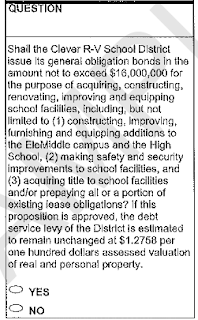

The Clever R-V School District has requested voters approve, on Tuesday April 2, 2024, a bond for $16 million for acquisitions, improvements, construction, and renovation at their various school buildings.

Voters should consider these points when deciding to approve or disapprove the proposed bond:

1) Will the proposed bond help increase student academic scores? Clever has among the lowest student scores in the county, despite having an ideal teacher to student ratio of 1:15.

2) Is the additional tax burden justified and reasonable? The Clever School District levy is currently at $4.6394 per $100 of assessed valuation of real and personal property, with $3.1636 of that going toward district operations, and the rest--$1.2758--going toward debt service (additional account that services the bonds). Currently, this alone represents over ¼ paid to Clever Schools in property taxes.

3) Does the Clever School District currently have bond debt?

According to the estimated tax collection the district could be within

$100,000 of all debt paid on their bonds. Currently the collection of tax

for the levy associated with the bond account is nearly $1.4 million in

revenue. However, knowing they were close to paying off the bond debt,

the District refinanced the 2017 bond at lower interest rate, but in

doing this kicked the can down the road to 2026 before they could call

it for payoff--which means they extended the loan with interest. Let

that sink in.

4) Has the population of students in Clever increased or decreased? There has been a reduction in student population in recent years; for example, in 2021-2022 there were 1,351 students, while according to January 2024 school board minutes we currently have 1,309 students. Surrounding schools are also slowing or stagnant in student population growth, even though the population as a whole has increased.

5) How much local tax revenue has the school district received and is it increasing or decreasing? Total local revenue in 2022 was $4,563,636. The estimated current tax year revenue is $5,015,274, an increase of $451,638. Additionally, tax reassessments of property (not counting new construction) is up over 6%, which means more money for the District. Note, the local tax effort increased from 2020-2021 through 2022-2023 by $782,192. Combined, this is over a million dollars in extra property tax revenue in four years. Remember, this is just local tax revenue!

About 2,750 homes serve the school district with property taxes. The median income in town is $53,000, while total median household income serving the Clever School District is $63,295. The median for Christian County is $66,500. Yet we have the highest property tax levy associated with the school district in Christian County. (Income obtained from Clever Schools RSP presentation stats for 2022.)

6) What are the payments and interest going to be on the $16 million bond? Take a look at the repayment plan (Bond Debt Service) that is on page 17 of the Raymond James Public Finance company's "Financial Overview of the District." Over the term of the loan, the interest payments on the $16 million bond would total nearly $8.8 million and would not end until 2043.

Taxpayers can get a copy of the plan by emailing the Clever School District and requesting a copy of the "Financial Overview of the District" by Raymond James.

Page 17 of the District overview

8) Does the language on the ballot matter? It does! It says, "If

this proposition is approved, the debt service levy of the District is

estimated to remain unchanged at $1.2768 per one hundred dollars

assessed valuation of real and personal property." The language

should read "to remain unchanged," which protects the taxpayer from any

levy increases during the contract. For instance, if tax revenues would

decrease for whatever reason, the District might not be able to make

their payments on the bond, and would have to increase the tax levy,

thereby burdening taxpayers in perpetuity. The use of the word

"estimated" gives the District the wiggle room to increase the levy. "Estimated" means taxpayers could be subject

to levy increases if needed to pay the debt. That $1.2758 could turn

into $1.40--all based on a forecast of 4% increase in property values,

averaged.

8) Does the language on the ballot matter? It does! It says, "If

this proposition is approved, the debt service levy of the District is

estimated to remain unchanged at $1.2768 per one hundred dollars

assessed valuation of real and personal property." The language

should read "to remain unchanged," which protects the taxpayer from any

levy increases during the contract. For instance, if tax revenues would

decrease for whatever reason, the District might not be able to make

their payments on the bond, and would have to increase the tax levy,

thereby burdening taxpayers in perpetuity. The use of the word

"estimated" gives the District the wiggle room to increase the levy. "Estimated" means taxpayers could be subject

to levy increases if needed to pay the debt. That $1.2758 could turn

into $1.40--all based on a forecast of 4% increase in property values,

averaged.

Additionally, the ballot language would allow the District to push off some of their internal debt (called lease-purchase debt) onto the taxpayer. It is made unclear how much that will be; as of last fall the total internal debt was $5,985,000.

9) What about renters who don't pay property taxes? If renters ever wonder why their rent is raised every year, and thought they had a greedy landlord, they should realize that when property taxes go up, the landlord is paying more for the rented home, and thus must raise rents in order to keep pace with taxes. Additionally, a percentage of the personal property tax that everyone pays on their vehicles also goes to the schools. Everyone suffers from ever-increasing property taxes!

10) What about SB 190, the tax freeze for seniors? That bill caps assessments on property for those eligible for Social Security, but it does not protect elderly homeowners from a levy increase. It only caps the value of the property.

11) Why should I vote? Nothing ever changes. While our national votes don't seem to matter much, your vote in local elections has major impact. Few people vote in off-year elections, so those who do vote have an outsized impact on what happens in your community. It can and has come down to a single vote that can elect a new mayor or alderman or approve/disapprove a bond issue. Your vote in a local election has a direct impact on you and your community.

12) What about the Hancock Amendment? Clever Schools has been taking advantage of the loophole in the Hancock Amendment that caps property tax increases to 5% for the District's Operations Account. The District has been transferring a portion of the levy funds from the Operations Account to the Bond Account (which pays down the bond debt). This is a type of legal but unethical "shell game" to keep any and all of the increase over the 5% excess revenue on existing property, instead of returning it to the taxpayer. (Last year was over a 6% increase.)

13) But it's for the children! We all want our schools to be able to have what they need to function well. When we lead with emotional sentiment it can cloud judgment of what is appropriate or reasonable. This tax affects everyone, low income, fixed income, even the children who will be paying off this bond debt for 20 years! Stop and think about that. These loans last about 20 years, and when we approve them, the payments and interest will affect the next generation of students.

14) Is there a better way? Yes. I have found nothing stating that we cannot save money through a tax levy in the District's Capital Projects Fund, where not only can the debt be for a shorter stated period, but with a reduced levy rate the school gets all the property tax revenue that is collected instead of 33% (over $8.7 million) in interest going to the bank and putting our next generation in debt. It would remain our approved debt with a clearly defined contract. It is a win for everyone. We can navigate the needs of the school in a more productive, clear and efficient way.

For example, a 50-cent "saving levy" in the Capital Projects Fund would be approximately $500,000 per year currently in tax revenue. If approved, for say, five years, it would be $2.5 million for stated projects. Currently, according to the Raymond James contract of the proposed $16 million bond, the interest alone over the next five years is higher than the proposed example.

We should live up to our name and be more Clever in how we do things.

Additional Resources:

Clever Missouri Hold on to Your Wallets

Christian County Election Calendar