By David Rice

According to the Missouri Independent, Mike Kehoe stated during the campaign,

“Since I’ve been in state government, we’ve cut the income tax from 6%

to 4.7%,” Kehoe said. “I have backed $2.4 billion in tax cuts since I’ve

been in office. But now, we need to take that to zero. That’s a key to

our economic development strategy.”

He’s working closely with two organizations, Americans for Prosperity and the American Legislative Exchange Council, to help push bills through this session to accomplish his campaign promise.

He’s working closely with two organizations, Americans for Prosperity and the American Legislative Exchange Council, to help push bills through this session to accomplish his campaign promise.

@RareCamellia [Camellia

Peterson] is an AFP Lobbyist, self-declared Libertarian [Big-Government

Libertarian], and School Choice [Tax-Funded Private and Homeschools]

proponent. Experience has shown that it is always worth investigating

how her benefactors manipulate the tax code if she is behind something.

Missouri's

2025 legislative session has revealed two competing visions for tax

reform, each with dramatically different impacts on how Missourians will

pay taxes. One plan aims to directly reduce taxes, while another

reorganizes how taxes are collected while maintaining state revenue.

The

bill Kehoe supports doesn’t reduce spending, though I am sure they will

claim their pretensions of tax cuts. Under Kehoe’s tenure as Lt.

Governor, spending in Missouri doubled from ~$27B to ~$52B. This year,

his budget is $54B. Kehoe stated they cut $2.4B in tax cuts, yet they

spent so much money that it is hard to see where the tax cuts occurred.

Bill SponsorsSenator Mike Moon, widely recognized as the Senate's most conservative member, has introduced Senate Bill 1029. His proposal would phase out corporate income tax entirely by 2029, reducing it by 0.8% each year until it reaches zero.

On the other hand, Representative Bishop Davidson, not known for conservative values, introduced House Bill 100 and House Joint Resolution 1.

These bills are backed by Americans for Prosperity (AFP), a

pseudo-conservative advocacy group, and the American Legislative

Exchange Council (ALEC), an organization that develops model legislation

for state lawmakers.

Bills are often written by front groups

like ALEC, who then convince Reps like Davidson to present them in

exchange for support during their runs for office. Reps like Davidson

rarely read the bills but are convinced easily because they want the

office and the prestige that comes with the office.

Several

senators, including Curtis Trent, Ben Brown, Nick Schroer, and Jill

Carter, have filed identical bills to increase the chances of passage.

These senators have shown more interest in serving their own re-election

than their constituents.

Two Different Approaches

Moon's approach is straightforward:

remove corporate taxes that businesses currently pass on to consumers

through higher prices. Companies paying less in taxes can reduce prices

on everyday items like groceries, shoes, and gas. His bill states,

"Beginning with the 2029 tax year, there shall be no income tax on

corporate income."

The AFP/ALEC plan is far more complex—this

complexity is purposeful. They don’t want you to be able to read it or

understand it. They disguise it using legal code. While marketed as an

income tax reduction, it introduces a European-style consumption tax

system known as the Value Added Tax (VAT). Here's how it works:

First,

they expand what can be taxed. The plan removes Missouri's current ban

on taxing services (adding a new tax) and sets a sales tax rate of

"three and seven hundred seventy-five thousandths percent" on goods and

services. This means you'll pay taxes on products and services like car

repairs, haircuts, and professional fees.

This is taking more

money out of your pocket that you can’t afford and giving it not to the

business owner but to the government. Taxes—corporate taxes—always go to

the government. They don’t go to the business. The people who pay for

them are the end consumers—you and me. Mike Moon understands this.

AFP/ALEC also assumes you’re stupid and will be easily fooled.

Second,

they create a "Tax Reform Fund." The bill states, "if the amount of net

general revenue collected exceeds the anticipated general fund revenue

expenditures for a fiscal year by one million dollars or more," that

extra money goes into this fund.

Finally, they promise income tax

relief, but with conditions. The law says income tax rates can only be

reduced "if the tax reform fund reaches and maintains a minimum balance

that is greater than or equal to one hundred twenty million dollars." In

other words, you'll only see income tax relief if the state collects

enough extra money from the new service taxes.

Here is Mike Moon’s Plan:

People won’t give the government any more money when they buy goods through corporate taxes.

The end.

Here is the AFP/ALEC Plan

People will now have a new tax through haircuts, car repairs, and professional services.

People will pay more for groceries, gas, and goods.

If

people have paid enough money through the VAT tax system and been good

boys and girls, and only if the government gets $120M in reserves will

they get an income tax break.

There are no guarantees that there will be a reduction to 0%. It’s only proposed.

The

government does not have to reduce its spending but is encouraged to

spend more under this model. Under Mike Moon’s model, the government has

to reduce its spending because it generates less revenue from the

taxpayer.

Understanding the European Model

The AFP/ALEC plan mirrors

the Value Added Tax (VAT) system used in Europe. Under a VAT system,

taxes are built into the price of goods and services at every step of

production and sale. While your paycheck might look bigger because of

reduced income tax, you'll pay more every time you purchase anything

from a good to a service.

So, the corporations still have to pay

their taxes to Missouri every step of the way under the AFP/ALEC plan,

which gets pushed to you. Then, they will add new taxes, which get

driven to you again. The corporation doesn’t pay taxes on anything. The

consumer pays taxes on everything. Taxes for a business are a cost built

into the price of every tube of toothpaste, every roll of toilet paper,

and every bag of Tostidos.

The AFP/ALEC plan doesn’t assist you

or save you money unless you can somehow drop out of the economy and

live as a homesteader. Yet, this won’t work because they will rely on

income tax if you do. You would have to quit working and buying not to

pay any taxes into their system. A few of us are hardy enough to do

that, but most of us do not have the resources to live as a homeless

person.

Think of it this way: Moon's system recognizes that

government taxes on businesses make your groceries, shoes, and gas more

expensive. He wants to make those items cheaper by removing those taxes.

The AFP/ALEC system says they'll give you more money in your paycheck,

but only after you've paid higher prices on everything you buy and if

the state collects enough revenue from those higher prices.

Impact on Missourians

The

difference between these approaches is significant. Under Moon's plan,

corporate tax reduction would directly lower business costs, potentially

reducing consumer prices.

Under the AFP/ALEC plan, while your

paycheck might eventually show less tax withholding, you'll pay new

taxes on services and likely higher prices on goods to make up for it

without forcing the government to be lean or to force the government to

reduce its budget. If the government never reduces its budget, it may

have enacted a VAT and an income tax system, which we’ll never get rid

of.

Governor-elect Mike Kehoe has promised to eliminate Missouri's

state income tax—but you can be sure he will plan to increase your tax

burden. The state receives 65% of its revenue ($13.35 billion) from

income taxes. [Consider how much of our revenue comes from other sources

and how much we overspend right now.]

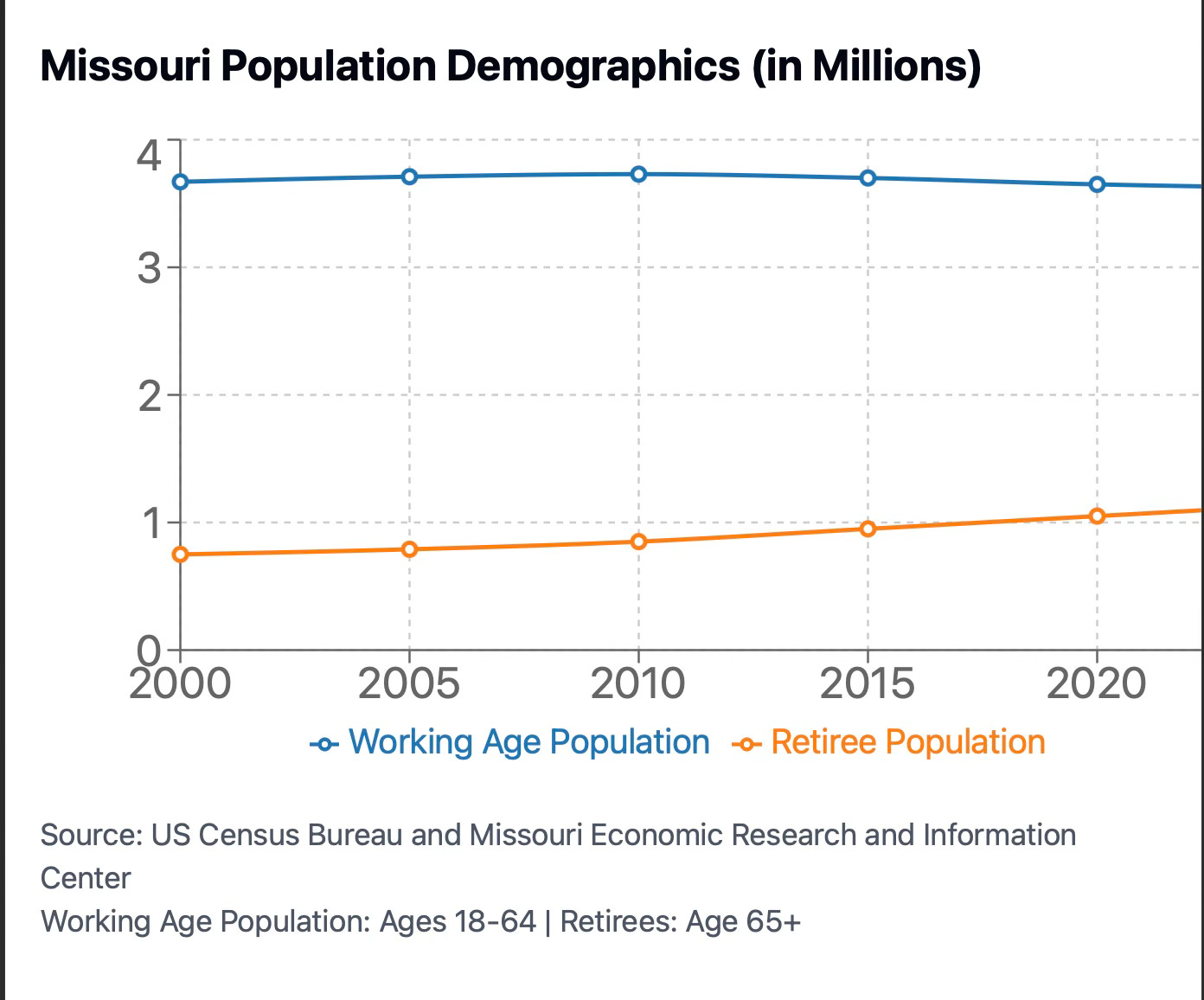

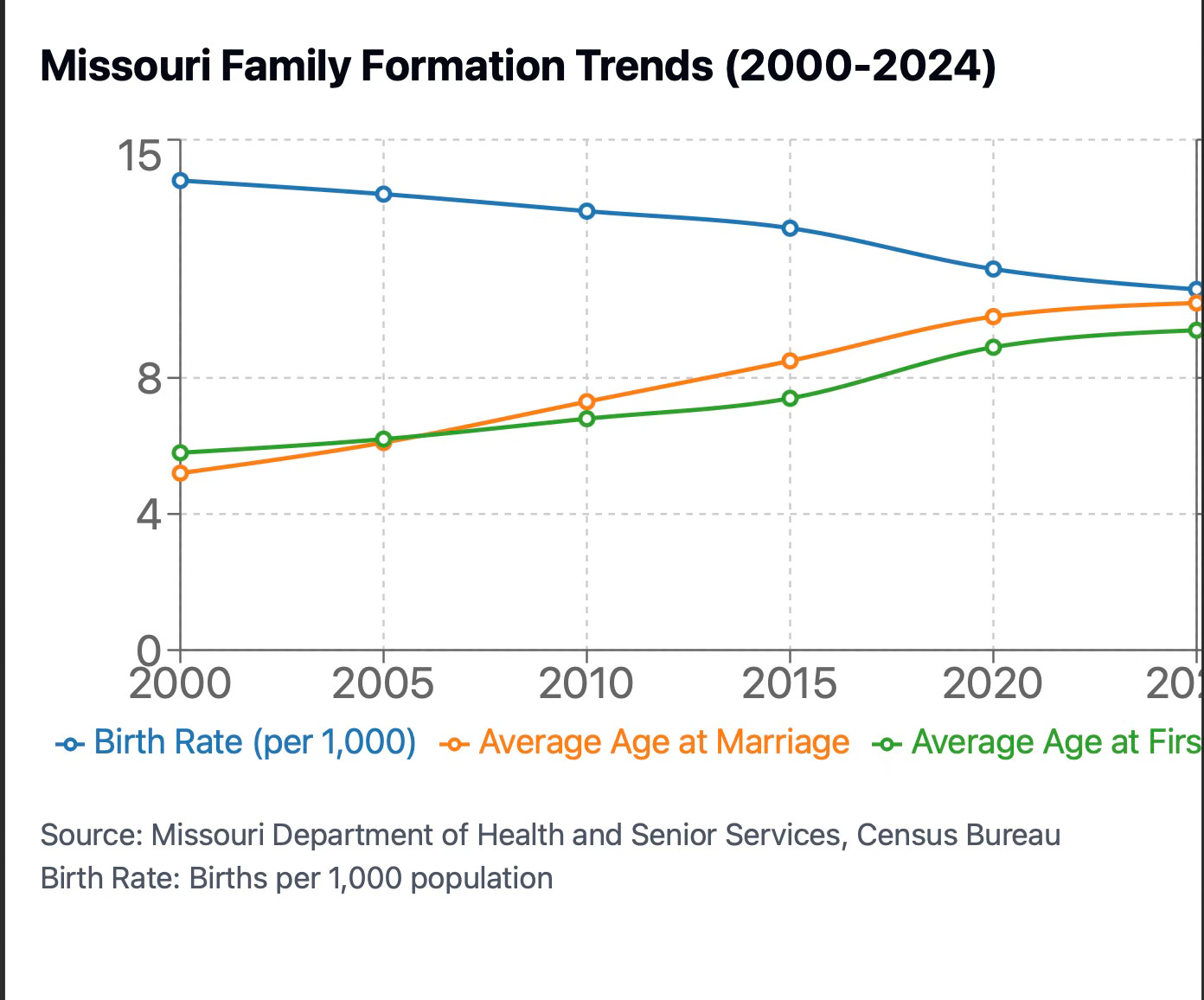

In 2024, Missouri’s income tax declined for the first time. Our

population is flat and not growing. Our children are not being born. Our

people are retiring and aging out of the job market.Do you

understand why they want a VAT? Because they can tax retirees using a

VAT when they can’t tax their retirement accounts. This is about an

aging population that must be taxed to maintain enormous expenditures.

With more young people postponing families, birthrates plummeting, and

family formation not occurring until a later age, AFP/ALEC is also

calculating they can take more of the expendable income from these young

individuals rather than encourage them to have families and have

children. They are managing our decline rather than trying to head it

off. They have decided the culture war is lost (a strange thing for

supposedly conservative groups to give up on), and they are helping RINO

legislators capitalize on it to spend more money like Democrats.

The AFP/ALEC plan ensures this revenue continues through expanded

sales taxes, while Moon's plan seeks an actual reduction in total tax

collection.

For Missouri taxpayers, the choice is between a

genuine tax reduction that could lower prices and our budget versus a

restructuring that maintains state revenue while making taxes less

visible. While the AFP/ALEC plan's promise of zero income tax sounds

appealing, the reality is that Missourians could end up paying the same

amount or more in total taxes, just in a different way.

The battle

over these competing visions will likely define Missouri's 2025

legislative session. Kehoe’s plan, backed by the AFP/ALEC, aims to

continue spending at unsustainable levels through a regressive tax

structure to take money from families who can’t afford to spare it.

Mike

Moon plans to reduce the costs for every family across the state by

removing the government’s invisible hand from business costs that we

don’t see in gas, groceries, and goods. Mike Moon’s plan doesn’t add a

new tax to our services or lock us into a new tax in our code that we

may never remove again.

Conclusion

The contrast between

these approaches reveals more than competing tax policies—it exposes

fundamentally different visions for Missouri's future.

The

AFP/ALEC plan represents sophisticated bureaucratic management that

accepts demographic decline as inevitable. It aims to maintain high

government spending through complex tax mechanisms by shifting tax

burdens to young professionals and retirees while making taxation less

visible but more pervasive. It's a nuanced strategy for managing

Missouri's diminishing population and changing demographics without

addressing the root causes of decline.

Moon's approach, by

contrast, represents a vision of economic liberty. By removing corporate

taxes that inflate the cost of everyday goods, his plan returns money

directly to people's pockets. This gives families more resources for

formation and growth while forcing the government to operate within

reduced means. Rather than managing decline through bureaucratic

complexity, it trusts Missourians with their own economic choices.

The

fundamental difference isn't just about tax rates or revenue

collection. It's about whether Missouri will accept and manage its

decline through sophisticated tax schemes or potentially empower its

citizens through economic freedom to reverse these trends.

Moon's

straightforward plan offers a genuine reduction in tax burden and

government scope, while the AFP/ALEC proposal ensures continued high

spending through an intricate web of consumption taxes.

For Missouri's future, the choice is between managing decay and enabling renewal.

Follow me on X @HickChristNews

HickChristian

is a reader-supported publication. To receive new posts and support our

work, consider becoming a free or paid subscriber.